japan corporate tax rate 2020

The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

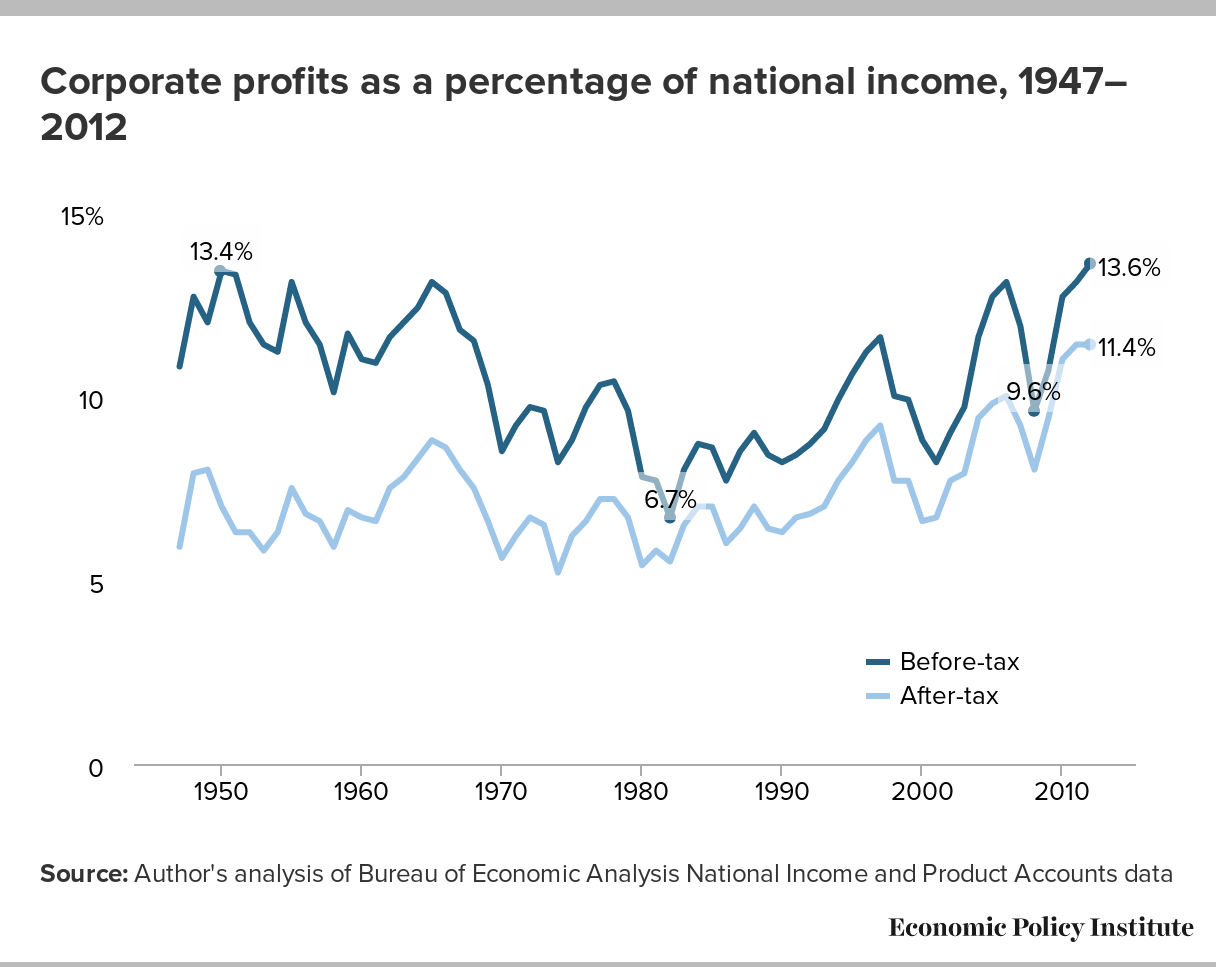

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

When weighted by GDP the average statutory rate is 2544.

. 13 February 2020 Japan tax newsletter Ernst Young Tax Co. Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Corporate tax rates table - KPMG Global - KPMG InternationalKPMGs corporate tax table provides a view of corporate tax rates around the world.

Historical Corporate Tax Rates and Brackets 1909 to 2020. Income from 0 to 1950000. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high.

Data published Yearly by National Tax. 2020 Japan tax reform outline. While the information contained in this booklet may assist in.

The Corporate Tax Rate in Japan stands at 3062 percent. Income from 1950001 to. However if the taxable earnings exceed this amount a rate of 15 is charged on the amount in excess of 30 million yen and up to 100 million yen and any amount in excess of 100.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief. Corporate - Group taxation. Taxation in Japan 2020.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Year Taxable Income Brackets Rates. The maximum rate was 524 and minimum was 3062.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. This booklet is intended to provide a general overview of the taxation system in Japan. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387.

2021 2020 2019 2018 2017 2016 2015. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1. Japan Income Tax Tables in 2020.

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of. Corporate Tax Rate in Japan averaged 4083 percent from. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021.

Real Estate Related Taxes And Fees In Japan

Business Capital Gains And Dividends Taxes Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporation Tax Europe 2021 Statista

Australia Tax Income Taxes In Australia Tax Foundation

Real Estate Related Taxes And Fees In Japan

Australia Tax Income Taxes In Australia Tax Foundation

Real Estate Related Taxes And Fees In Japan

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

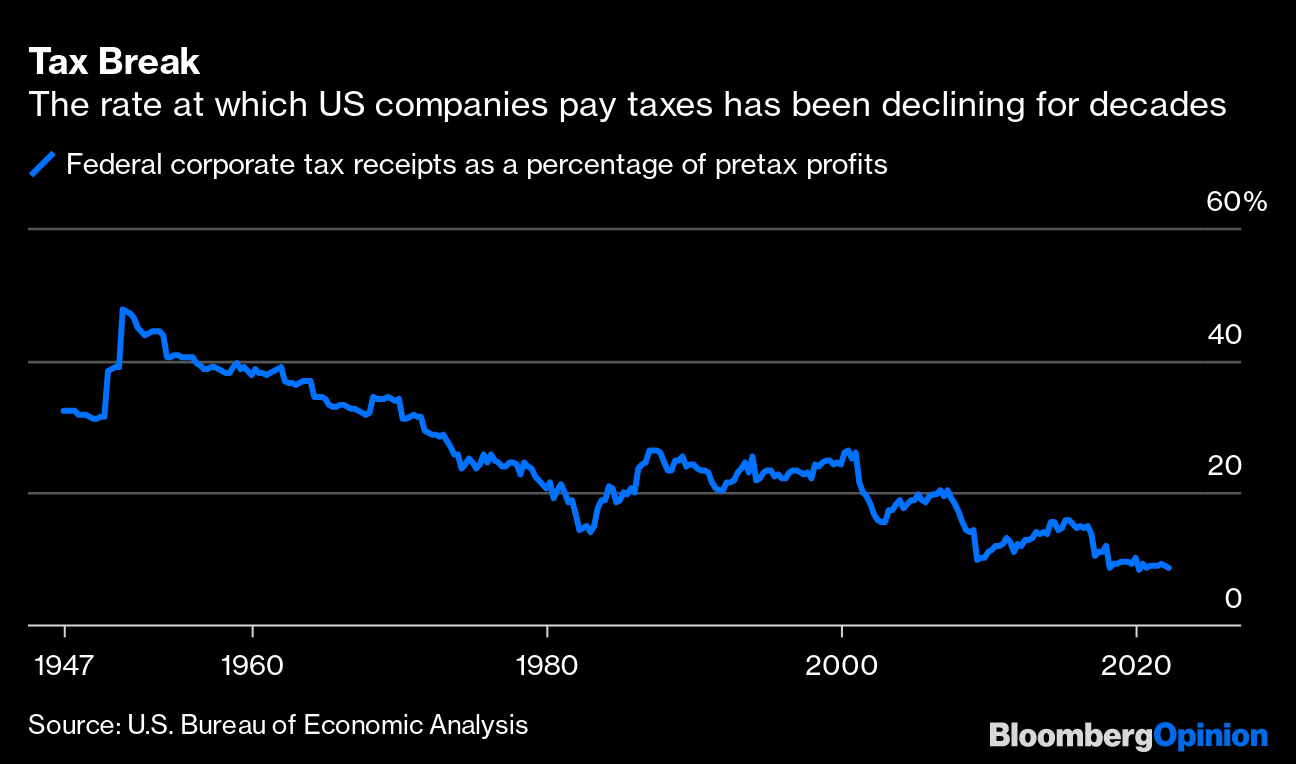

A 15 Minimum Corporate Tax Won T Raise Prices Or Cut Wages Bloomberg

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

2022 Corporate Tax Rates In Europe Tax Foundation

Canada Tax Income Taxes In Canada Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

What Would The Tax Rate Be Under A Vat Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget