are acquisitions good for shareholders

Even though competition can be challenging growth through acquisition can be helpful in. However rather than making an acquisition occasionally acquirers frequently conduct streams of mutual interrelated MA to fulfill their strategic goals for enhanced value.

Pdf Impact Of Mergers And Acquisitions On Shareholders Wealth A Study Of Telecom Sector Of Pakistan

Contrarily the empirical studies have proved that acquisition does not have a positive impact on the.

. Money information and discipline. May 3 2017. 10 Benefits and Advantages of Mergers and Acquisitions Economies of Scale Economies of Scope Synergies in Mergers and Acquisitions Benefit in Opportunistic Value.

The stock price meanwhile spiked 4 on April 17th as opportunistic traders bought up the shares in the hope that an acquisition might come to pass. Acquisitions constitute one of the most important corporate investments Chahine et al 2021 and carry rich implications for corporate financial performance Hagendorff. Target company stocks reaction.

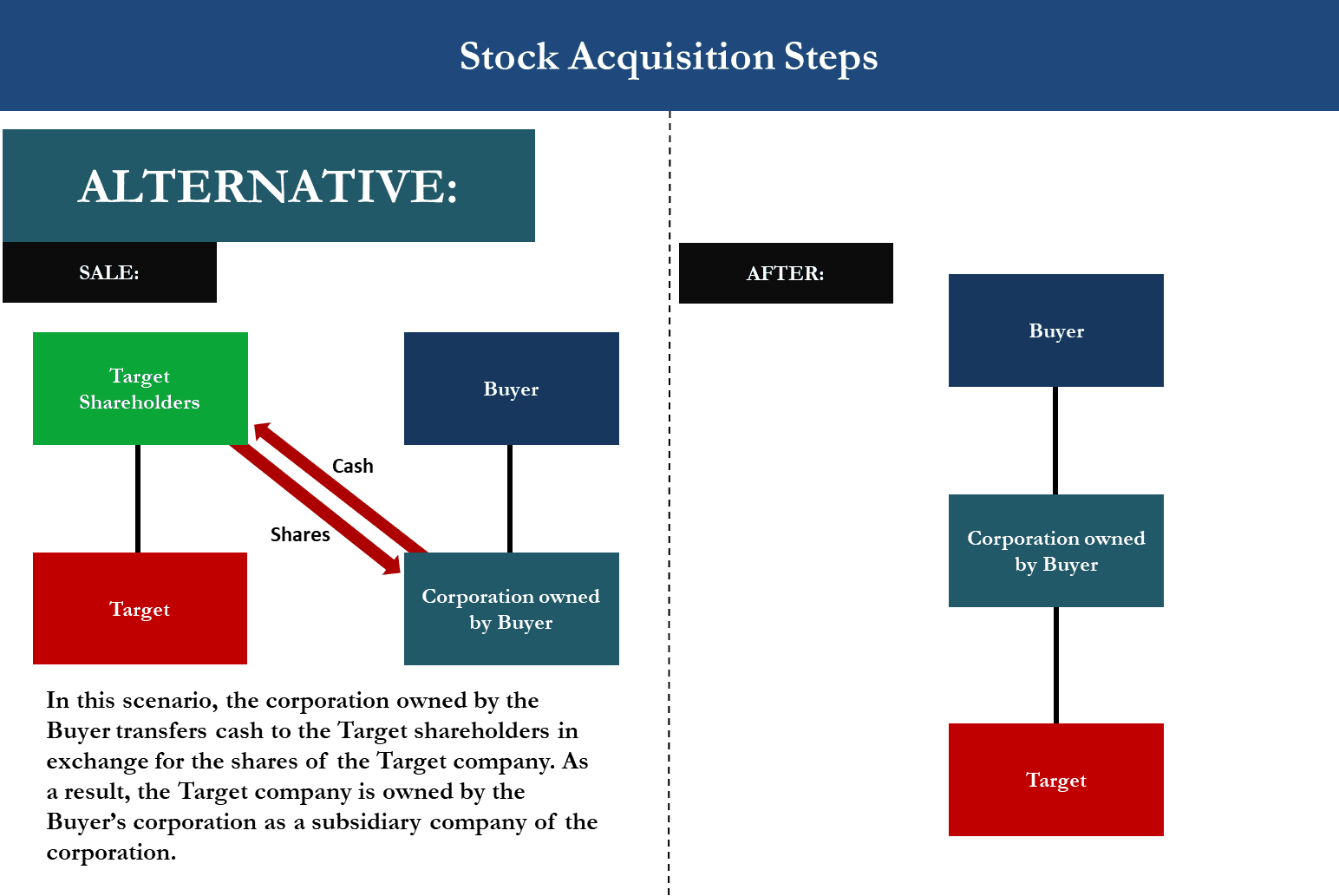

But for management acquisitions to occur a majority of a companys shareholders must approve of the transaction. Money The most straightforward job of the shareholder is to provide funds. 2 Following the announcement.

Before we dive into our discussion on shareholder approval and the different types of mergers and acquisitions a brief reference to the overall US MA market can be useful for. Management of either company could become disenchanted and leave creating a significant risk of failure. The impact of acquisitions on shareholder wealth.

Weve divided shareholders contributions into three areas. What happens to shareholders in an acquisition. The announcement of these acquisitions cost the.

With shifting global market dynamics rapid advancements in technology and evolving customer demands companies are increasingly seeking growth to. When one public company buys another stockholders in the company being acquired will generally be compensated for their. What happens to shareholders in an acquisition.

Over our sample period the sample firms spent roughly 3 trillion on acquisitions. You have to meld two cultures and that doesnt always work out. Under the terms of the agreement Spirit shareholders will receive 19126 shares of Frontier and 213 in cash for each Spirit share they own.

While some transactions translate into an almost immediate boost to shareholder value some acquisitions particularly those which are hostile in nature lead to costs. 26 2016 Year-to-date through July over 800 billion of merger-and-acquisition MA activity has been announced in the US. The motive behind acquisitions is that they create value for the shareholders.

Further the research has provided recommendations to the companies for their decisions regarding mergers and acquisitions. An acquisition can help to increase the market share of your company quickly. Reasons for MA Companies merge with or acquire other.

Cash Vs Stock Acquisitions M A Form Of Consideration

Basic Structures In Mergers And Acquisitions M A Different Ways To Acquire A Small Business Genesis Law Firm

Analyst Five9 Shareholders Should Reject Zoom Acquisition Offer

Takeovers In Australia A Guide Ashurst

Deal Accounting In M A Simple Process Walkthrough

Mergers How Corporate Mergers And Acquisitions Impact Small Investors The Economic Times

Shareholders Wealth Effects Of Mergers Acquisitions In Different Deal Activity Periods In India Semantic Scholar

Aon Willis Towers Watson Shareholders Approve Merger

Sailpoint Technologies Shareholders Approve Acquisition By Thoma Bravo Seeking Alpha

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

Mergers Acquisitions M A Valuation Street Of Walls

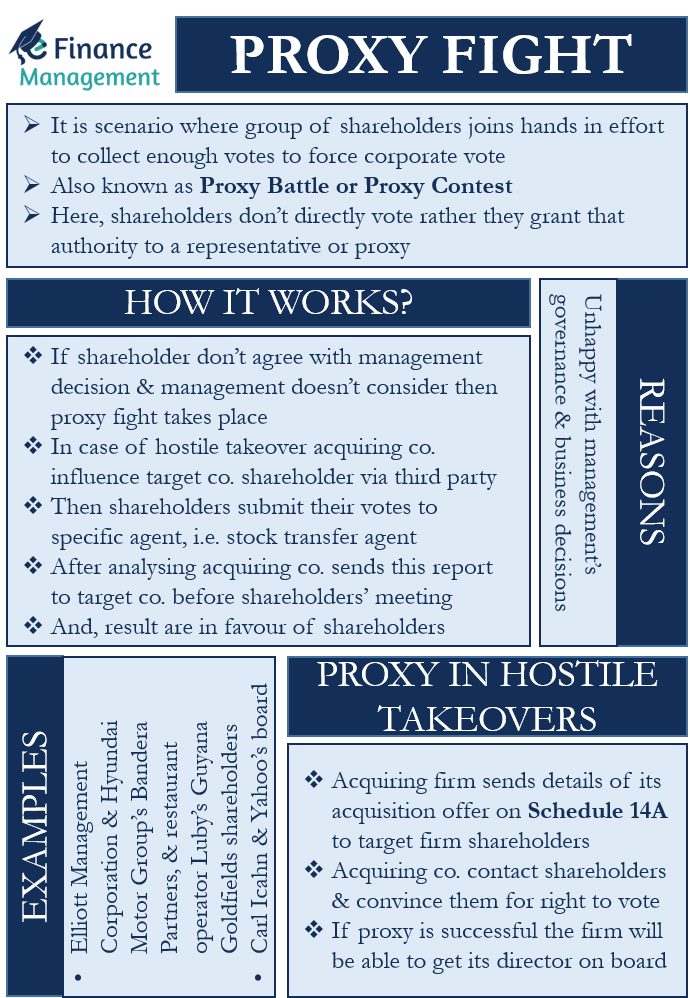

Proxy Fight Meaning Reasons Examples And How It Works

4 Advantages Disadvantages Of Remaining A Shareholder After An Acquisition

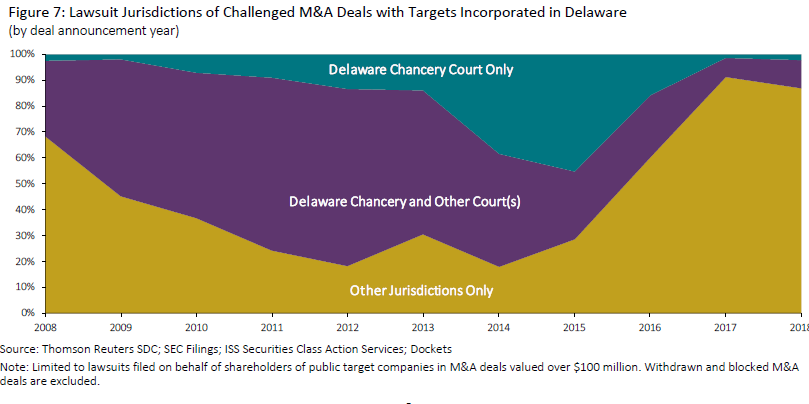

Acquisitions Of Public Companies 2018 Shareholder Litigation

Are You Paying Too Much For That Acquisition

Stock Or Cash The Trade Offs For Buyers And Sellers In Mergers And Acquisitions

/GettyImages-801479766-4fa7b4a1dd1d49b799565a733c9fb29d.jpg)

How Company Stocks Move During An Acquisition

Franklin Templeton Just Acquired Legg Mason Will This Create Value For Shareholders The Motley Fool

Solved The Following Statements Are Incorrect Except Chegg Com